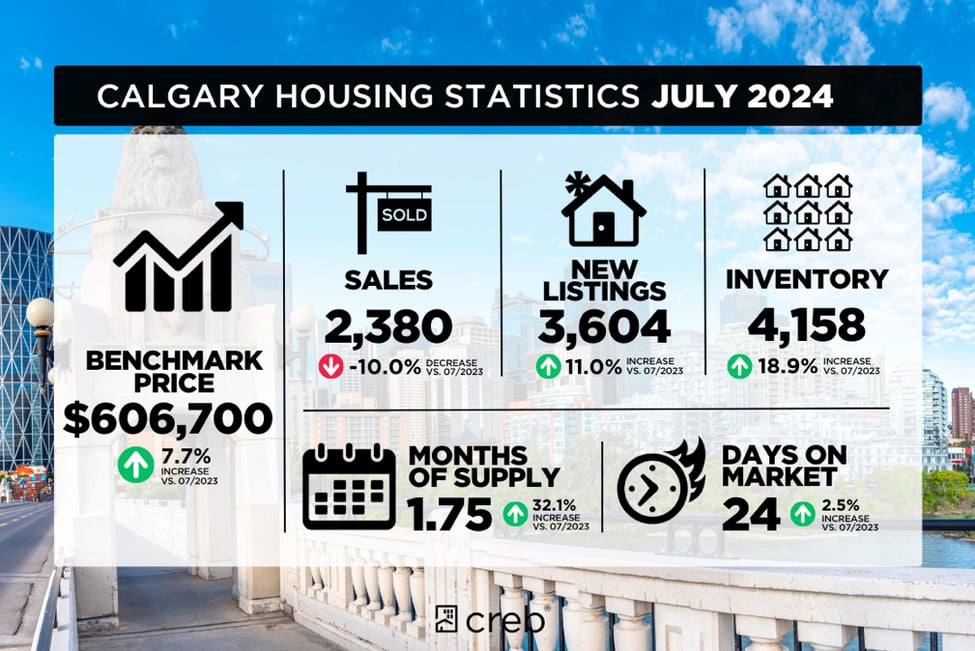

As we transition from the bustling spring market, we're beginning to notice some shifts in supply levels. The market saw 2,380 sales alongside 3,604 new listings, resulting in a sales-to-new listings ratio of 66%. This shift has contributed to an increase in inventory, which rose to 4,158 units. While this is still 33% below typical July levels, it's noteworthy as it's the first time in nearly two years that inventory has exceeded 4,000 units.

The majority of the supply growth has been in homes priced above $600,000. This increase has helped ease the extreme sellers’ market conditions that dominated the spring. According to Ann-Marie Lurie, Chief Economist at CREB®, "While we are still dealing with supply challenges, especially for lower-priced homes, more options in both the new home and resale market have helped take some of the upward pressure off home prices this month." This aligns with expectations for the latter half of the year, and if inventory continues to rise, we may see more balanced conditions and price stability.

July sales saw a 10% decrease compared to last year's record highs, but they still surpassed long-term trends for the month. The decline in sales was primarily seen in homes priced below $600,000. Despite the slowdown, the combination of increased inventory and slower sales has pushed the months of supply to 1.8 months. While this still favors sellers, it's a notable improvement from the less than one month of supply reported earlier this year.

The improved supply has also slowed the pace of monthly price growth across all property types. In July, the total residential benchmark price was $606,700, roughly the same as the previous month and nearly 8% higher than last year’s levels. As the market adjusts, buyers and sellers alike can anticipate a more balanced environment in the coming months.